Icestore vs Blue Nile: The Lab Diamond Price Comparison Nobody Wants You to See Updated: January 2026

- Ari Gold

- Jan 4

- 7 min read

Updated: Jan 4

Let me tell you a story about two companies selling the exact same product at wildly different prices. And by "wildly different," I mean one charges you $7,210 while the other charges $1,790 for the identical diamond. Same certification, same specs, same sparkle.

Spoiler alert: We're the cheaper one. But you probably guessed that already, or you wouldn't be here reading an article with this title.

The $5,420 Question

Before we get into the weeds, let's establish some facts. In the first few days of January 2026, I pulled up two 4.04-carat Asscher cut lab diamonds—both F color, VS1 clarity, Excellent cut, IGI certified. One was listed on Blue Nile for $7,210. The other was on our site for $1,790.

That's not a typo. That's not a promotional discount. That's just Tuesday.

You're probably wondering: What's the catch? There must be something different about these diamonds, right? How could lab diamond prices vary so much between vendors? Blue Nile wouldn't charge four times more for the same thing, would they?

Oh, my sweet summer child (wait, I was a summer child). Let me introduce you to the wonderful world of corporate overhead, private equity acquisitions, and marketing budgets that could fund a small nation.

Let's Talk About Signet for a Minute

Here's something Blue Nile's sleek website probably didn't mention when you were browsing: Blue Nile is owned by Signet Jewelers. You know Signet—they're the folks behind Kay, Zales, Jared, and as of 2022, both Blue Nile and James Allen.

So when you're comparison shopping between Blue Nile and James Allen, thinking you're being a savvy consumer weighing your options? Congratulations, you're comparing Pepsi to Pepsi in a different can. Same parent company, same profit margins, same incentive to keep prices exactly where they are.

Signet paid $490 million for Blue Nile. That's not a joke. Half a billion dollars. And here's the thing about spending half a billion dollars on an acquisition: you need to make it back. With interest. And the way you do that is by maintaining the margins that made Blue Nile an attractive acquisition target in the first place.

This is Economics 101, dressed up in a pretty website with 360° videos (Our videos are better).

The Boutique vs. The Warehouse

Icestore serves a handful of clients per day. That's it. We're not trying to process hundreds of orders before lunch. We're not answering to shareholders in Cincinnati. We're not justifying a $490 million acquisition to a board of directors who want their ROI.

We're a 24-year-old business run by one person who frankly got tired of seeing people overpay for diamonds back when Bush was still president—the first one.

Blue Nile, on the other hand, is running what amounts to a diamond warehouse operation dressed up as a luxury experience. They need volume. They need scale. They need to hit numbers that justify being part of a publicly traded company with quarterly earnings calls.

And all of that—every single bit of that corporate infrastructure—gets baked into the price you pay.

Real Comparisons, Real Numbers

Let's look at more examples, because one could be a fluke. Except it's not.

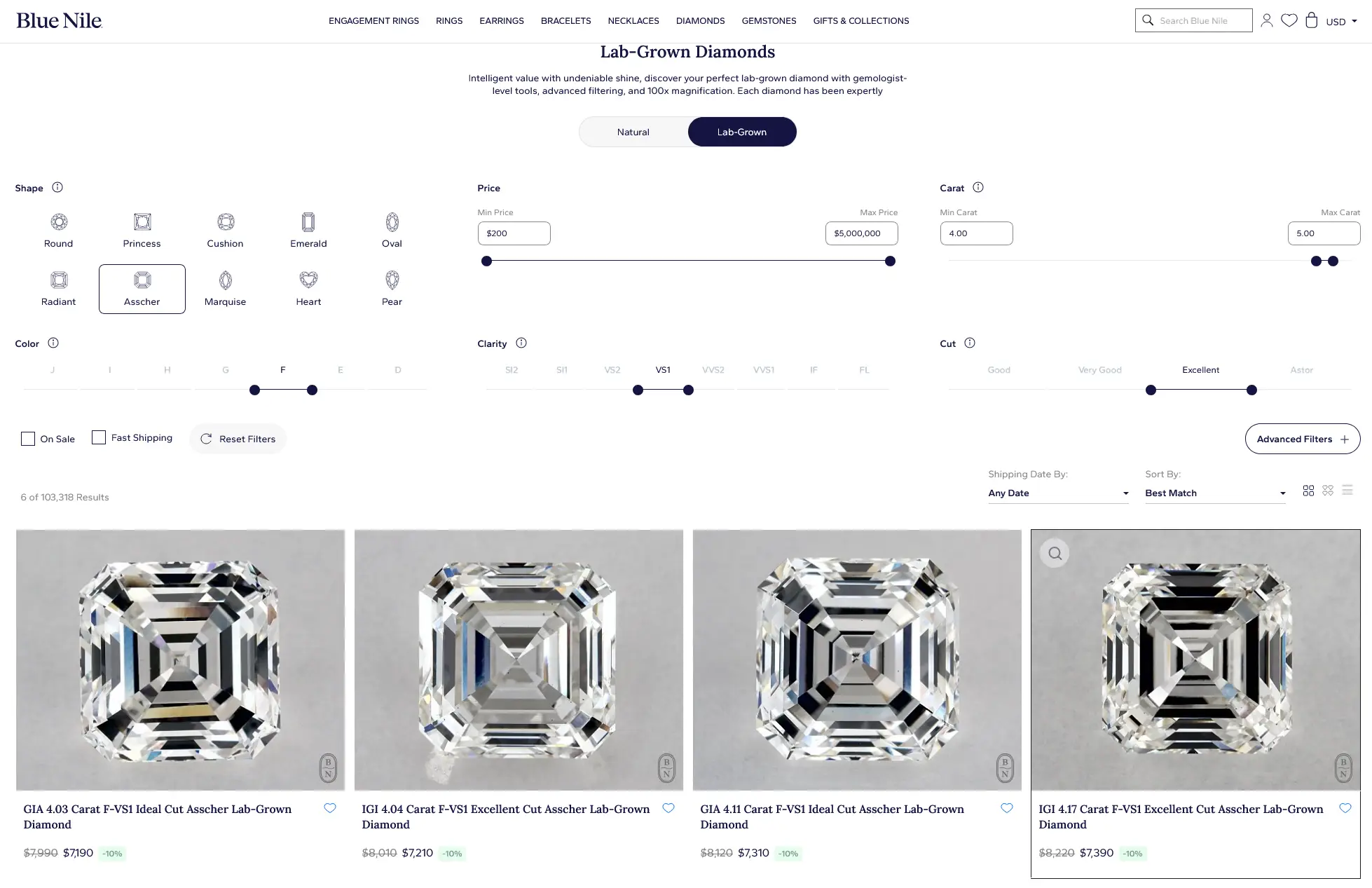

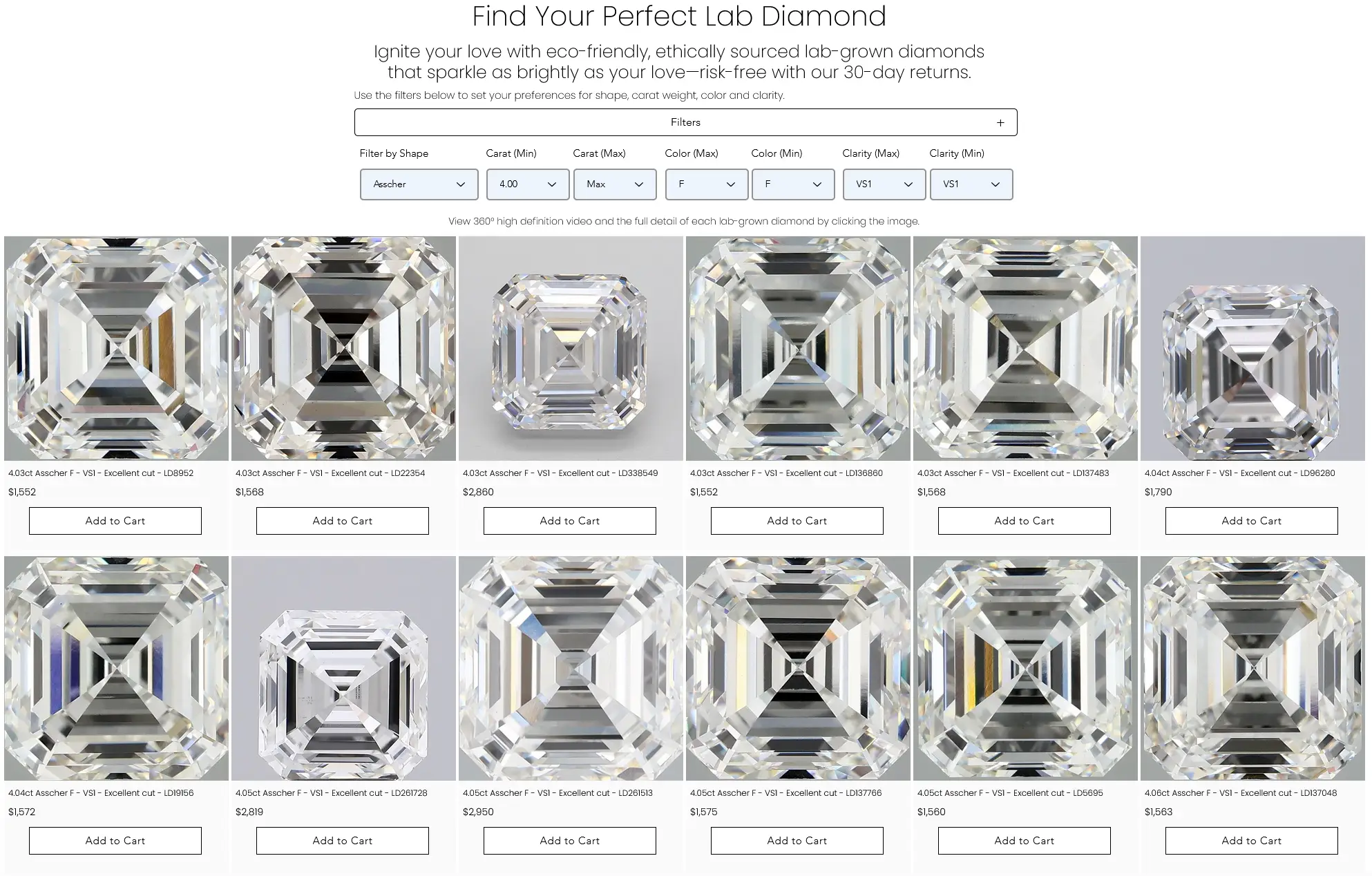

Example 1: The 4.04-Carat Asscher

Specs: F color, VS1 clarity, Excellent cut, IGI certified

Blue Nile: $7,210

Icestore: $1,790

At Icestore you save: $5,420 (75%)

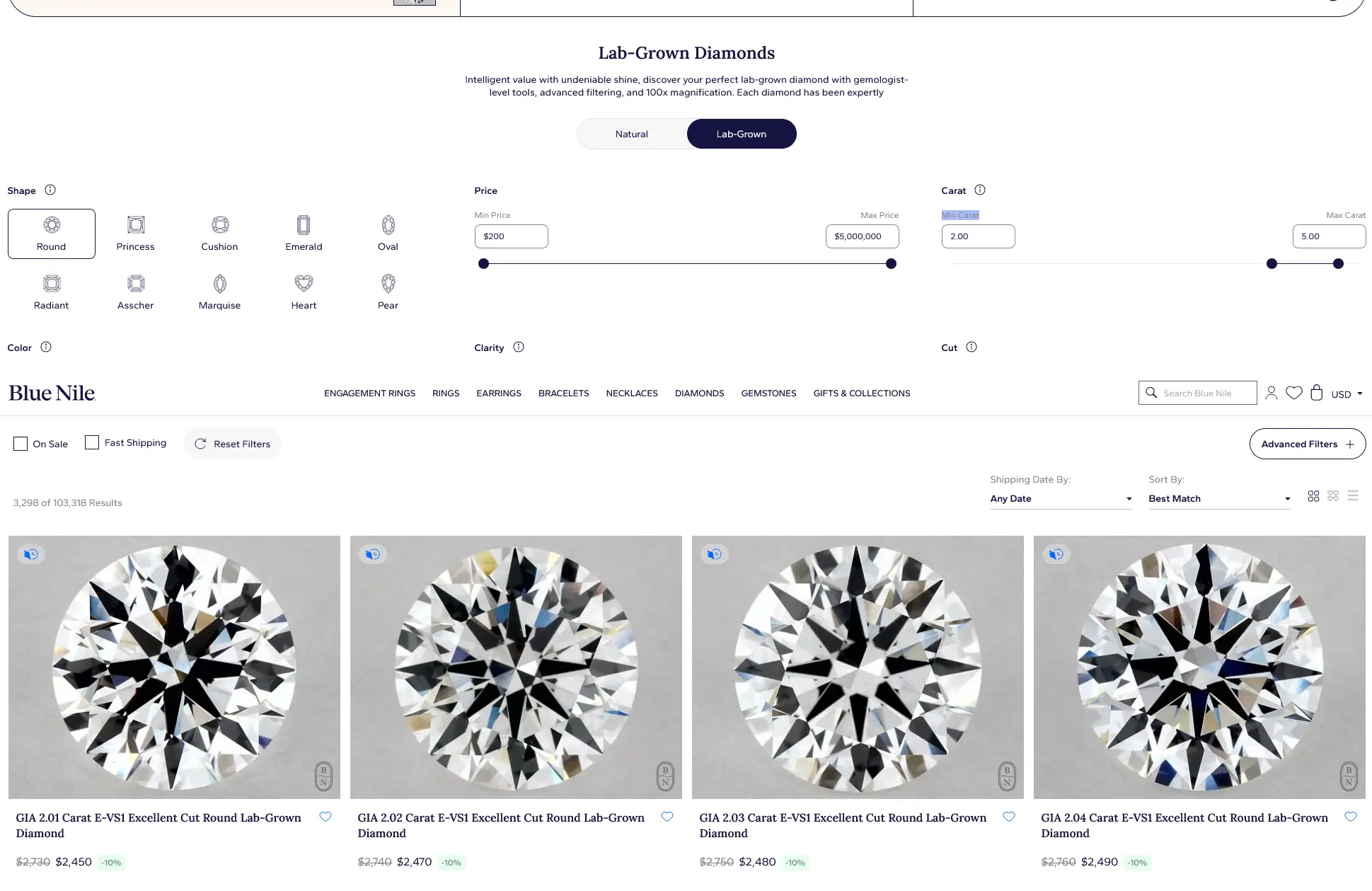

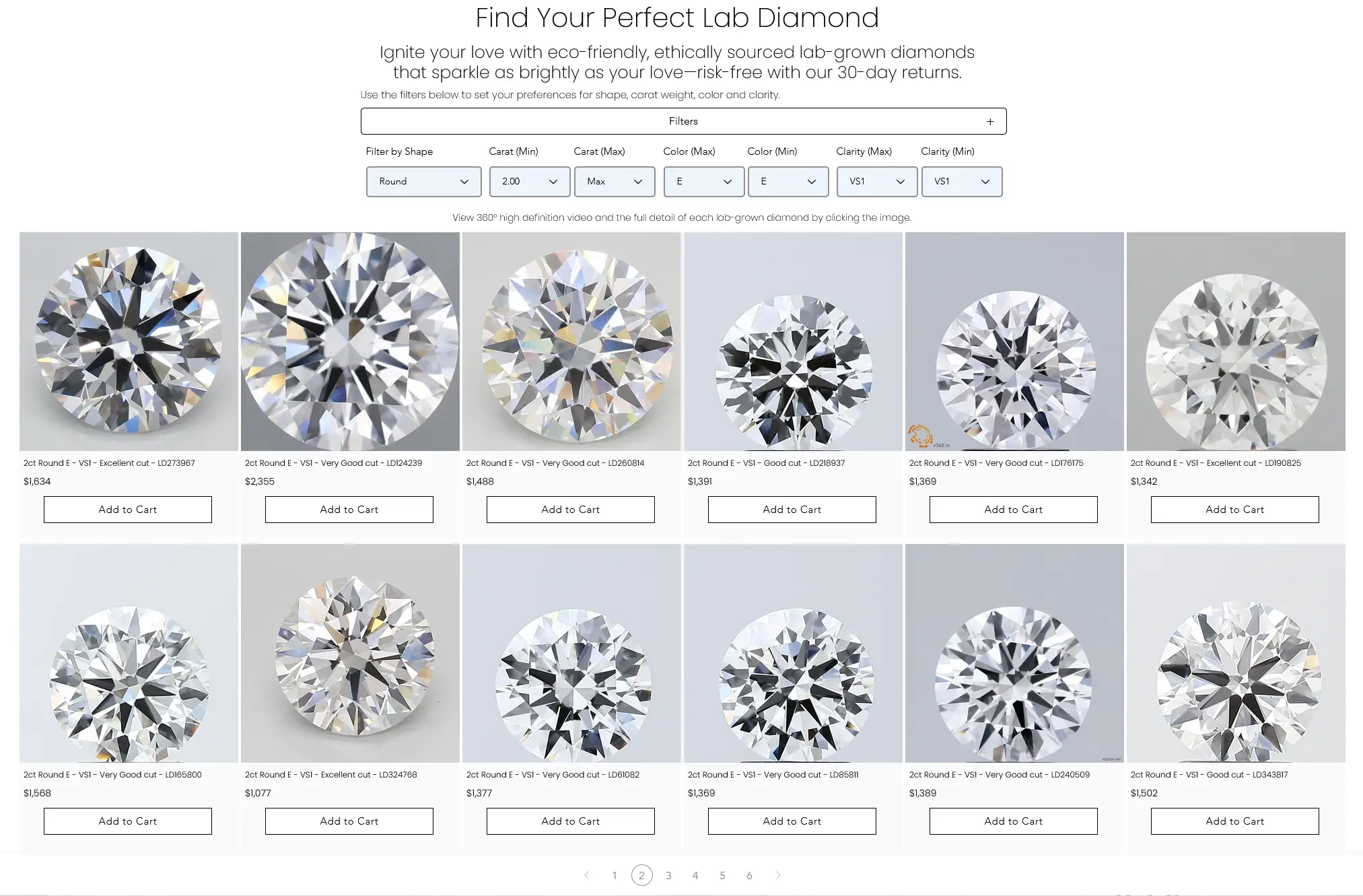

Example 2: 2.00-Carat Round Brilliant

Specs: E color, VS1 clarity, Excellent cut, IGI certified

Blue Nile (least expensive): $2,500

Icestore (least expensive): $1,077

Typical savings: $1,430 (40%)

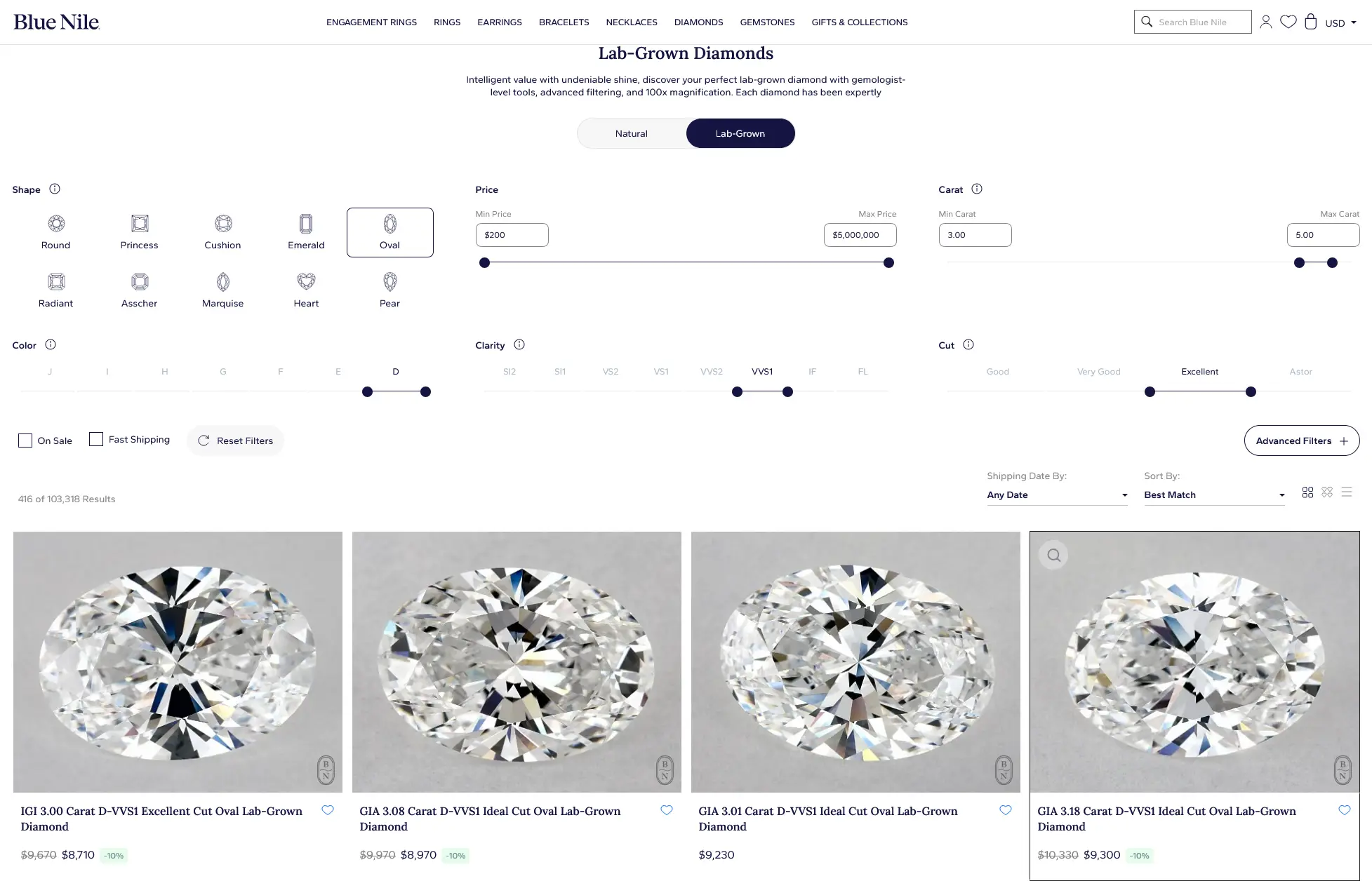

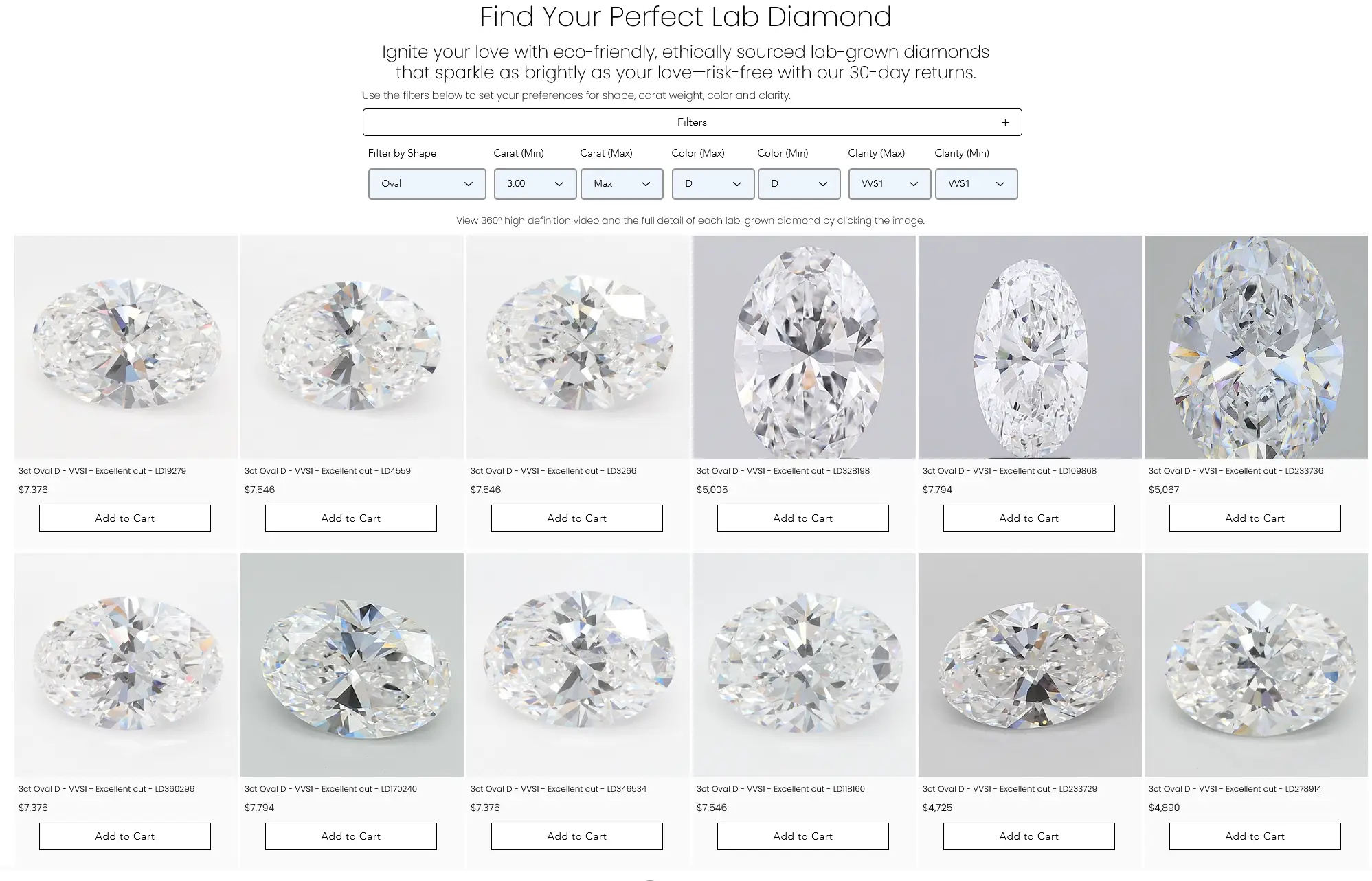

Example 3: 3.00-Carat Oval

Specs: D color, VVS1 clarity, Ideal cut, IGI certified

Blue Nile (least expensive): $8,710

Icestore (least expensive): $4,725

Typical savings: $4,000 (46%)

The pattern holds across shapes, sizes, and quality grades. The gap narrows slightly on smaller stones (because there's less margin to squeeze) and widens dramatically on larger ones (because that's where the real money is made).

"But Blue Nile Has Free Returns and Great Service!"

So do we. Next question.

Seriously though, let's address the elephant in the room: Blue Nile has spent millions convincing you that their "customer experience" justifies the premium. They've got the slick website, the aggressive Google Ads, the partnership integrations, the Super Bowl commercials (probably).

Here's what we've got: an A+ BBB rating with literally zero complaints, 5-star Google reviews, and 24 years of not screwing people over. We also have free returns, free shipping, lifetime warranties, and GIA/IGI certification on everything.

The difference? We're not paying for Times Square billboards. We're not sponsoring influencers. We're not running retargeting ads that follow you around the internet like a desperate ex. We're just here, selling the same diamonds at prices that reflect actual costs rather than corporate profit targets.

How We Actually Source Diamonds

Blue Nile sources through the same wholesale networks everyone uses. We source through the same wholesale networks everyone uses. The diamonds come from the same manufacturers, the same labs, the same certification bodies.

The difference is that we don't have seven layers of corporate bureaucracy between the manufacturer and you. We don't have regional managers who need company cars. We don't have a marketing department of 40 people optimizing landing page conversion rates.

It's just me, a laptop, direct relationships with manufacturers built over 24 years, and a complete lack of interest in paying for a Park Avenue office.

The Inconvenient Truth About Lab Diamonds

Here's something else they won't tell you: lab diamonds cost pennies on the dollar to produce compared to what anyone charges for them. We're talking hundreds of dollars for stones that retail for thousands.

Now, that's true whether you're buying from us or Blue Nile. The difference is in how much of that margin gets extracted as profit.

Blue Nile needs to cover:

The $490M acquisition debt

Signet's corporate overhead

Marketing budgets that would make a presidential campaign blush

Shareholder dividend expectations

Executive compensation packages

That fancy office space

Icestore needs to cover:

My mortgage

Server hosting

Actually competitive pricing

Guess which business model leads to better prices for you?

The Reviews Nobody Wants to Talk About

We love when people look us up on BBB or Google. Go ahead, I'll wait.

Found anything? Any complaints about bait-and-switch tactics? Any stories about receiving inferior diamonds? Any accusations of shady business practices?

No? Weird.

Now, I'm not saying Blue Nile has bad reviews—they're actually pretty good for a company their size. But here's the thing: when you're charging 60-75% more than you need to, you can afford really excellent customer service. You can afford to eat returns. You can afford to be generous with policies.

We just price things fairly from the start and skip the theater.

Who Should Buy from Blue Nile?

I'm going to be brutally honest here, because unlike a $490 million corporate entity, I can afford to be.

You should buy from Blue Nile if:

You have money to burn and don't care about value

You really, really love the brand name and the reassurance of dealing with a massive corporation (Like Bain Capital or Signet)

You're profoundly uncomfortable with the idea of buying from a small business

You enjoy paying premium prices for the peace of mind that comes from... actually, I'm not sure what peace of mind you're getting that our A+ BBB rating doesn't provide

Look, I'm not going to tell you Blue Nile sells bad diamonds. They don't. They sell the exact same diamonds we do, certified by the exact same labs, with the exact same chemical composition and physical properties.

They just charge you three times more for them.

The Part Where I Get Real

I started Icestore in 2001 because I was appalled by jewelry store pricing. Not mildly annoyed—appalled. I watched people spend $20,000 on diamonds that cost the jeweler $4,000, and I thought, "This is insane."

Twenty-four years later, the industry has only gotten worse. Corporate consolidation has reduced competition, private equity has prioritized shareholder returns over customer value, and marketing budgets have exploded to maintain the illusion that massive markups are somehow justified. You hear things like, "It's the cut of OUR diamonds". Really? Are your diamond somehow cut to better than Ideal proportions? Perhaps you've discovered how to warp time and space to get a more brilliant diamond using 11th dimension quantum phyisical effects? No? In the case of Bluenile they made up a grade they call "Astor". Perhaps that's short for "Astor"onomically overpriced. "Astor"nishingly expensive? Okay I'll stop now.

Blue Nile used to be the disruptor. They were the ones challenging traditional retail margins and offering better prices online. Then they got successful, got acquired, and became exactly the thing they once disrupted.

We're just here doing what Blue Nile used to do before they decided quarterly earnings were more important than customer value.

What You Should Actually Do

Don't take my word for any of this. Please.

Go to Blue Nile right now. Find a diamond you like. Write down the exact specifications: carat weight, color, clarity, cut grade, shape, certification.

Then come to our site and find the same specs. Not similar—identical. Same certification body (GIA or IGI), same grades across the board.

Compare the prices.

Then ask yourself: what am I getting for the extra $3,000, $5,000, or $8,000?

If the answer is "peace of mind from dealing with a big company," okay. That's your call. Your money, your choice.

But if you can't articulate what you're paying for beyond vague feelings of corporate legitimacy, maybe—just maybe—you're paying for Signet's acquisition debt and not for anything that actually benefits you.

The Bottom Line

We've been doing this for 24 years without a single BBB complaint. We have hundreds of five-star reviews from actual customers. We offer the same certifications, the same return policies, the same warranties, and the same quality as Blue Nile.

We just charge 60-75% less.

Is this an advertisement? Obviously. I'm not pretending to be Consumer Reports here.

But it's an advertisement based on verifiable facts that you can check yourself in about three minutes.

The question isn't whether Icestore offers better value than Blue Nile. We do. The question is whether that value matters to you more than the alleged comfort of dealing with a relentless marketing machine.

For 24 years, thousands of people have decided it does.

We'll be here when you're ready.

Ready to compare?

Browse our lab diamond inventory or schedule a consultation to discuss what you're looking for. No pressure, no sales tactics, just honest information about what things actually cost.

Ari Gold

Founder, Icestore

Still annoyed by jewelry industry pricing and behavior since 2001

Comments